An open ended debt scheme predominantly investing in debt instruments of

Banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds

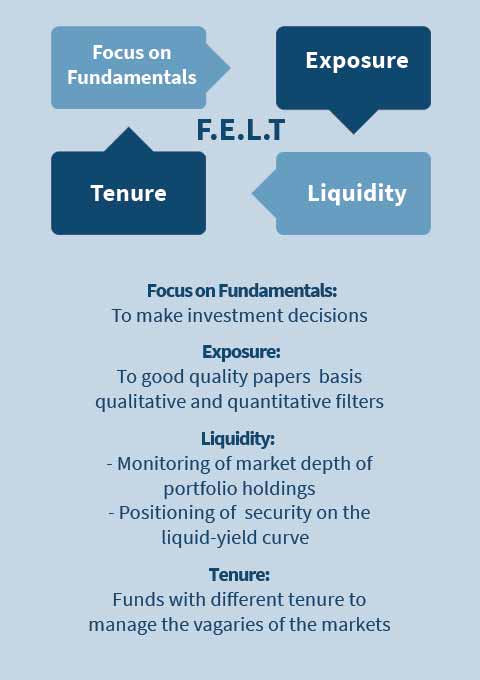

The Fund aims to generate income through predominantly investing in Debt instruments of Banks, Public Sector Undertakings, Public Financial Institutions

Focus on accrual from high quality Banking and PSUs, and low proportion from rate movement

The fund invests in high quality securities

The fund focuses on generating accrual income from quality Banking & PSUs Debt Instruments

The fund aims to provide optimum returns while remaining focused on safety and relatively better liquidity

Strong private banks are adequately capitalised as well as possess the ability to raise further resources & PSUs come with credit strength derived from government shareholding & regular support

Suitable for Investors

Seeking regular income over short term to medium term

Looking for an investment avenue with lower credit risk and relatively better liquidity

With an investment horizon of 3 years or more

| Scheme Name | TATA BANKING & PSU DEBT FUND |

| Investment Objective | The investment objective of the scheme is to generate reasonable income, with low risk and high level of liquidity from a portfolio of predominantly debt & money market securities issued by Banks, Public Sector Undertakings (PSUs), Public Financial Institutions (PFIs) and Municipal Bonds |

| Type of Scheme | An open ended debt scheme predominantly investing in debt instruments of Banks, Public Sector Undertakings, Public Financial Institutions and Municipal Bonds |

| Fund Manager | Amit Somani |

| Benchmark | CRISIL Banking and PSU Debt Index |

| Min. Investment Amount | Rs. 5,000/- and in multiples of Re. 1/- thereafter |

| Load Structure | Entry Load: N.A Exit Load : Nil |

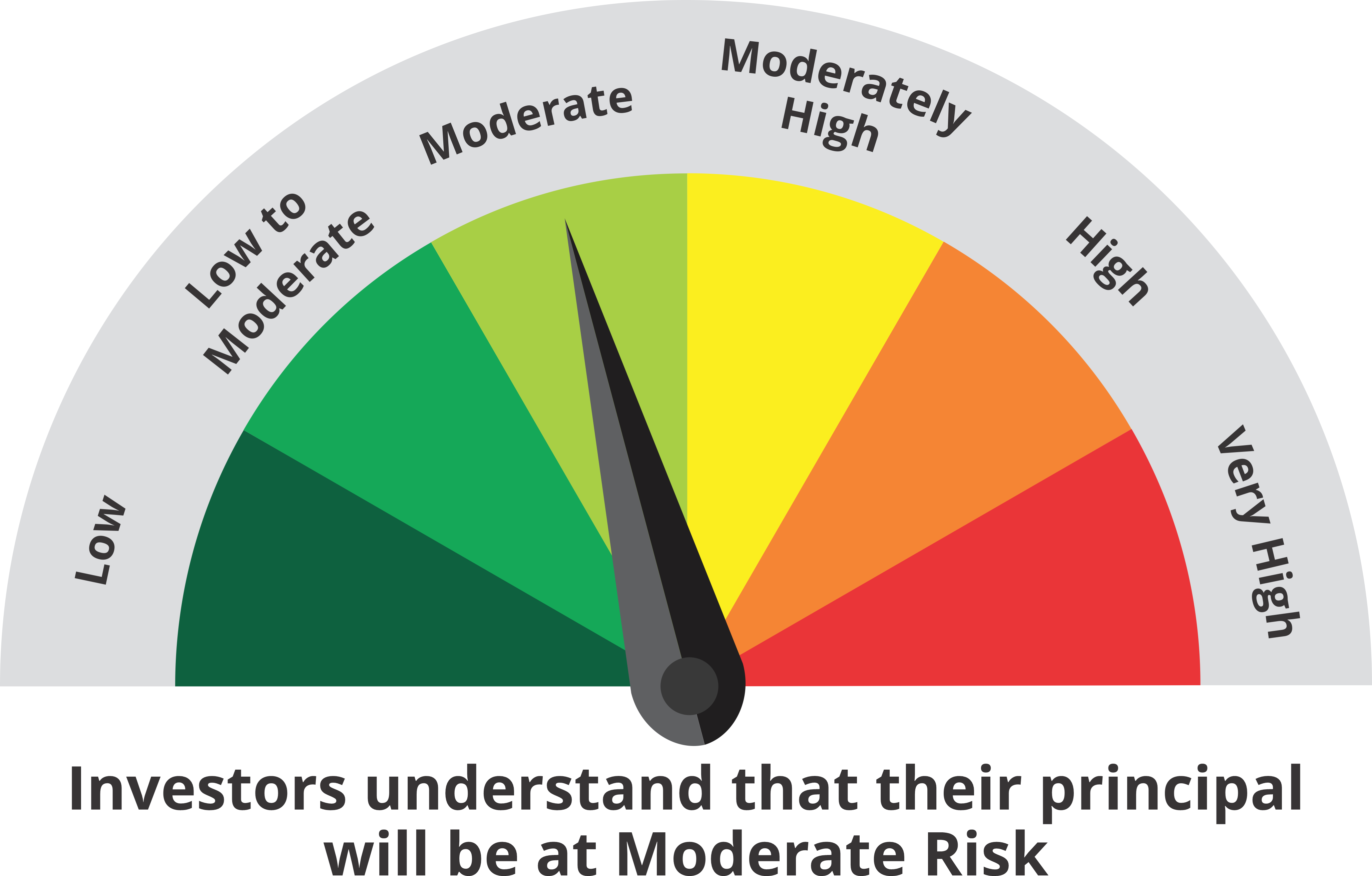

This product is suitable for investors who are seeking*:

*Investors should consult their mutual fund distributor if in doubt about whether the product is suitable for them

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Corporate Office Address:

Tata Asset Management Private Limited, 19th floor, Parinee Crescenzo, ‘G’ Block, Bandra Kurla Complex, Opposite MCA Club, Bandra (E), Mumbai – 400051